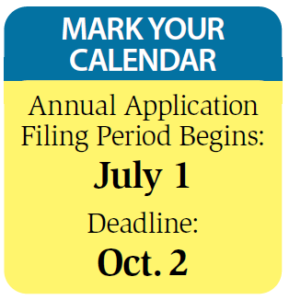

If you’re a Honolulu homeowner concerned about property taxes, relief is on the horizon as the City and County of Honolulu announces its Real Property Tax Credit program, open for applications starting July 1.

If you’re a Honolulu homeowner concerned about property taxes, relief is on the horizon as the City and County of Honolulu announces its Real Property Tax Credit program, open for applications starting July 1.

From July 1, eligible homeowners can apply for a tax credit to help alleviate their real property tax expenses. To qualify for this tax credit for the 2024–2025 tax year, applicants must:

Have a home exemption on their property

Ensure that none of the titleholders own other property anywhere

Confirm that the combined gross income of all titleholders meet income requirements.

The amount of the credit homeowners will receive, if qualified, is based on their income and current property tax amount. This tax credit program is aimed at providing much needed relief to homeowners who are affected by rising property taxes.

Homeowners who applied for this credit during the 2023–2024 Tax Year can expect to receive an application in the mail in early July.

Contact the Tax Relief Office for an application or download it from the website starting July 1.

TAX RELIEF OFFICE

For more information or questions, call 808-768-3205

or visit honolulupropertytax.com

(Information furnished is subject to change without notice.)

Leave a Reply