Story by Haley Burford

Photography by Steve Nohara

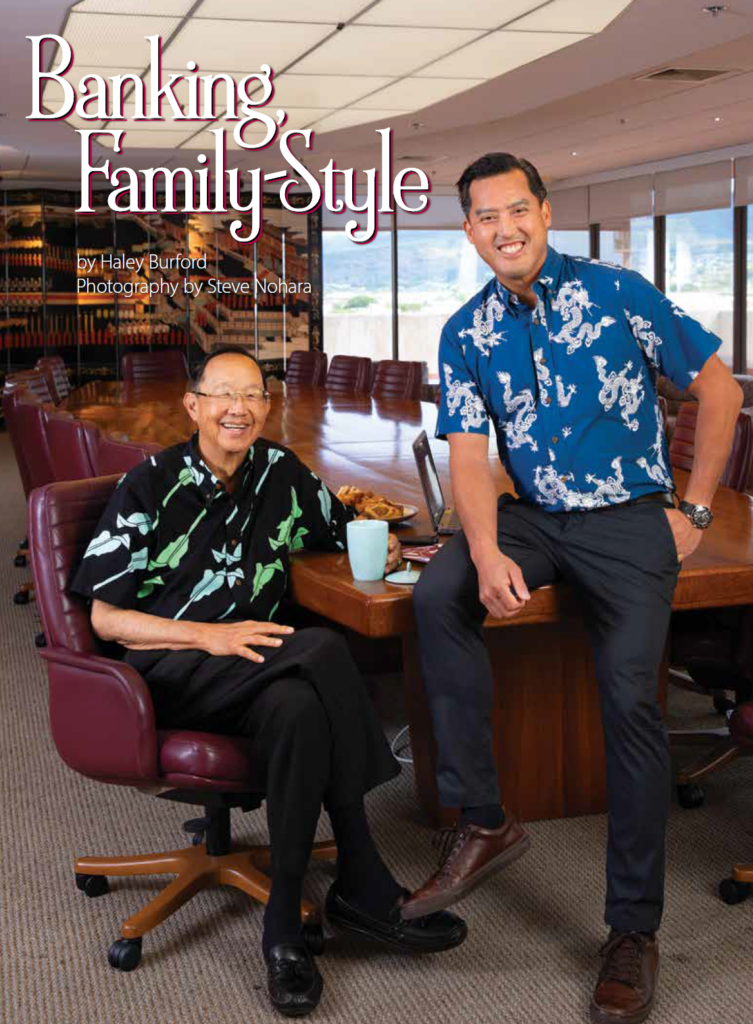

The words “family” and “business” are not mutually exclusive to Hawaii National Bank’s owners and operators. HNB is at once a “business family” and a “family business.” For the last 64 years, the Luke family has supported small businesses, family businesses and each other with their intrinsic knowledge and practical experience. They know what it takes to run a family business because they are a family business. But a name plaque on a desk at the bank is not assured simply for being a family member alone. A member of the Luke family must earn that honor by having the aptitude, talent and passion for the banking business.

The Luke family’s community bank has thrived, as have their clients, utilizing a business model that assesses intangibles, prioritizes Hawai‘i’s people and incorporates integrity, philanthropy and responsibility as its core values.

The family’s principles, policies and values govern the way the bank engages in business, establishing a code of conduct that drives employee behavior at all levels and builds trust between the bank and its customers. These foundational family standards guide the company’s actions, influence its culture and determine how the bank interacts with customers, employees and the community. They serve as a compass for decision-making and help align the goals and vision of the company with the behaviors of its workforce.

Big bang beginnings

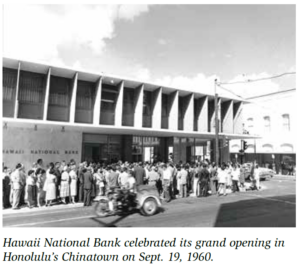

Hawaii National Bank (HNB) celebrated its grand opening with a bang and the pop of 10,000 firecrackers in Honolulu’s Chinatown on Sept. 19, By the end of that very first day, the bank had received about $6.25 million in deposits, setting a national record for first-day bank deposits in the United States. From that point onward, HNB has maintained its status as a top-tier financial institution in Hawai‘i.

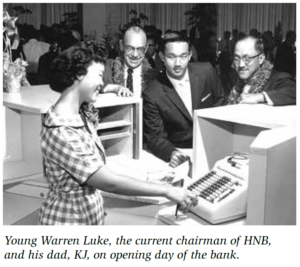

Hawaii National Bank prides itself on being locally owned and operated. It is through their highly personalized and intimate philosophy that HNB has garnered and retains a clientele that consists of not only individual account holders, but families and small businesses, too. Brought into being by KJ Luke and a group of local businessmen in 1960 as a publicly owned bank, upheld by Warren Luke and now headed by the third generation, Bryan Luke, HNB and its nine branches continue to grow with our ever-evolving Hawai‘i, maintaining its well-deserved reputation every step of the way. HNB is a community bank, with all decisions made locally, and they are traditional in the sense that both commercial and retail banking services are provided to customers. HNB aims to lead us down the path of financial literacy, security and relationship-building they feel we all deserve.

An upward trajectory

KJ Luke began his work life at his father’s general store on the Big Island. Years later, he graduated from the University of Hawai‘i with a degree in accounting. While applying for a job at a local bank, he ran into his accounting professor, who encouraged him to pursue an advanced degree instead of a job. Luke responded by saying, “I will send in an application, but if I don’t get accepted, I want you to help me get this job.” Luke was accepted to Harvard Business School, earning an MBA (Master of Business Administration). He was later awarded the school’s highest honor, the Alumni Achievement Award, becoming the very first Chinese-American to earn such an accolade.

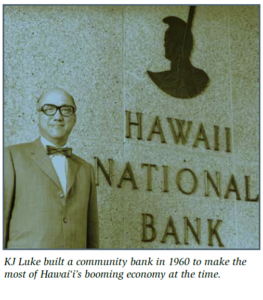

KJ Luke went on to become one of Hawai‘i’s most successful businessmen and real estate investors. Among his many achievements in the realm of his business ventures was his idea of building a new bank to make the most of Hawai‘i’s booming economy at the time. He wanted to prioritize building strong interpersonal relationships and taking care of Hawai‘i’s diverse local population.

Taking on the responsibilities of president and chairman of this new project, Luke applied and then was approved for a federal charter to open the only national bank in Hawai‘i.

Thus, HNB came into being, and was (and still is) highly regarded among the state’s people. Priding itself on being the “Home of Warm-Hearted Bankers,” through three generations of leadership, Hawaii National Bank strives to be there for the people, throughout all stages of their lives.

A legacy of excellence

After KJ Luke came his son, Warren. Warren Luke is the current chairman of HNB. Like his father, Warren attended Harvard Business School after obtaining his undergraduate degree at Babson College in Massachusetts. Championing the value of education for Hawai‘i’s (and the world’s) youth, Warren also involves himself in various nonprofits and boards, including Harvard Business School’s Asia Pacific Advisory Board and through supporting the Harvard Center Shanghai.

The third generation of Luke family legacy of excellence is Warren’s son, Bryan, the current president and CEO of HNB. Like his father and his father before him, Bryan also attended Harvard Business School and advocates for strengthening Hawai‘i’s economy, environment, education and entrepreneurship. He serves on multiple local and national boards, including Hawaii Community Reinvestment Corporation, the Pacific and Asian Affairs Council and the Rehabilitation Hospital of the Pacific.

The achievements of these men are not few. Their desire for change and capacity for compassion are not small.

Of course, all of these accolades and accomplishments are impressive, but to the Luke family, what they really celebrate are the close relationships they have built and kept with their clientele, and the family businesses and individuals they have worked with.

The family business

One of the core messages that Hawaii National Bank wants the people and small/family businesses of Hawai‘i to be aware of and understand is that they know what it takes to run a family business — because they are a family business.

Bryan spent time in the Bay Area and shared how he disliked being removed from a hands-on work environment. “I’d value businesses and intangible assets,” says Bryan. “I’d consider a lot of things you can’t see, touch or feel.”

After returning to Hawai‘i and working at the bank, Bryan realized he was right where he belonged. “Coming back home and working with local families and really seeing what we do and how we help our customers and businesses — and therefore, their families and the overall community — just made things way more tangible.”

Bryan feels that working at HNB is much more rewarding because the help provided to their customers can actually be seen making a palpable difference in their lives.

Warren interjects some insight regarding the evolving nature of banking and services today: “Banking is changing now because of IT [information technology] systems and what’s available online. So we have a lot of younger customers say, ‘Why do I need a banking relationship?’”

“There will be some time in your life when you’re going to need a relationship for a loan or understanding what you want to do — if you want to acquire a business or buy a house, you will need to go in and talk to a banking officer, or relationship officer,” says Bryan.

“That’s what we really concentrate on: relationships.” Bryan adds that HNB may be compared to the private banking group of a larger bank, as they offer more personalized service and opportunities to build a relationship with your banker.

Consistency, constancy & continuing change

When Warren began at the bank, he assessed the situation and realized that many of HNB’s senior officers were on the verge of retirement. He looked to the board about hiring a consultant. Bryan had worked for a consulting company, so the board hired him to do a project during the summer. He proved himself. They liked what he did, and the bank hired him.

“All of a sudden, I replaced my senior officers with officers in their 30s — it was a big change,” says Warren. With this change came the need to also update their IT systems, and it was a work-in-progress then just like it is today, especially with the rise of AI (artificial intelligence). He jokes, “So, working with the young people is fine.”

HNB has undoubtedly undergone changes in the 64 years it has been in existence. Bryan’s challenge was keeping the good parts of what the bank excels at but also evolving for the future.

“When I came onboard 18 or 19 years ago, we were about a $300-million bank in asset size,” says Bryan. “We’re at about $800 million now. One of the things we did really well when I first started was the relationship — the close contact that we had with a lot of our longtime customers. We were going through a generational transition and a lot of our customers were, as well, so the question became, how do we adapt for the next generation of leaders?”

To Bryan, figuring out how to maintain that close contact HNB prioritizes was paramount. “The fear that you have is twofold: one, not being able to keep up in terms of technology, but, two, maintaining that personal touch you have with your customers,” says Bryan. “You have to use a combination of both things and we spend a lot of time working on that.”

The business of family

The other thing Warren feels strongly about is upholding family. “I’ve been lucky because I’ve worked a lot in education. I was in a group to help with input on the family business practice at Harvard Business School. Now, there are a lot of schools that have family business sections that concentrate on family businesses. At Harvard, we concentrate more on the business family, because you have to work with a family to keep it together to make sure that the business can survive. If the family stays together, the business can survive a lot of different things. If the family doesn’t stay together, it’s very difficult.”

Why do Warren and Bryan feel so strongly about finding a balance between being a family and being a business? When asked to what extent it is important for HNB to be family-owned and operated with regard to their clientele, Warren answers, “We really wanted to take care of local businesses. Helping local business is our business.” Many local businesses in Hawai‘i are family-owned and locally owned, so HNB feels a duty to take care of them. “We wanted to be a community bank — a smaller bank. We have a lot of big banks in town and they cater to the bigger businesses, many of which are owned by companies headquartered on the mainland. As a community bank, in the long run, if you want to build your banking practice, I felt that it was easier to operate as a family-owned or private company than a public one. We started as a public company, but when you go through tough times in the economic sense, we had to ensure that we kept some of the equity to handle our growth and yet still take care of the local ownership, so that’s why the decision was made to go private.”

“Like my dad said, our market is locally owned, closely held companies, and because we are also one, we are better able to relate to our customers.”

The Luke family and HNB look at the “business family” as opposed to the “family business.” “When the next generation comes in and wants to make changes, the older generation doesn’t agree,” says Warren. “The business climate changes; what’s happening in town changes. You have to go with the flow and do it properly.”

Spanning the generation gap

The generational road of HNB’s leadership, transitioning from father to son, older to younger, is not without bumps along the way. When asked about the sorts of challenges that can come up when operating a generational, locally owned family business, Warren says, “It’s kind of separate. When you have a family-owned business, you must still look at the qualifications of the people running the business. The question is always, what’s more important: running the business like you run a family, or running it like a corporation? We have to do both. We must have qualified people coming in, so we have to make sure that the family members are qualified.”

“The other thing is generations change and their outlooks change.” Warren adds. “So, when it’s time for older generations to step aside and turn over the business to the younger, you must first make sure they’re qualified, then, you have to let them work with your current customers, because customers think differently now and expect different things.” With a laugh, he finally says, “Sometimes, the older generation has to learn to bite their tongue. Let the younger ones make mistakes, ‘cause they learn from their mistakes.”

Bryan finds it interesting how generational change will often bring with it a completely different way of thinking and operating a business: “I think we were pretty careful in that we want to make sure we keep the core of who we are, and then supplement it with — whether it’s new technology or whatnot — changing the company to move it into the future.” Bryan likes to say that half of his job is moving the company forward and the other half is not messing things up. “I think the benefit of that, too, is the fact that I am the third generation at the bank. When my dad came in and worked for his father, I got to see all the good and bad things, so it was a little bit easier for me to come in, since he already experienced that once before.”

When Bryan first started at the bank, he was often asked how parents can get their kids to come back and work for them — “the way you work for your dad?” He pondered these questions, assessing the benefits and drawbacks one should consider regarding staying at a mainland job or coming back home to work — a decision he had to make, and feels he made correctly.

The currency of philanthropy

HNB and the Luke family work with various nonprofits in the spirit of charity.

Bryan says, “I think a lot of that stems originally from my grandfather and a lot of what he did. My dad also does a ton of things — locally and internationally.” Warren has served on the local and national boards of the Red Cross and the United Way of America, as a trustee of Punahou Schools and Babson College, the Federal Reserve Board of San Francisco, the Pacific Basin Economic Council headquartered in Hong Kong, and is currently on the Asia Pacific Advisory Board for Harvard Business School. He is chairman of the Pacific and Asian Affairs Council, where Bryan is currently a board member. Bryan is on the board of Hawaii Community Reinvestment Corporation, among other organizations.

His auntie Loretta Yajima founded the Children’s Discovery Center in 1989, and his auntie Janice Loo is president of the Takitani Foundation and a director of Rehab Hospital of the Pacific.

“Really, it’s about starting from an early age through your whole life.” Warren found by serving on the boards, many problems and topics are similar. Bryan connects this philosophy to the life cycle of a bank customer. The life cycles of people involved in the community carry over, crossing boundaries and overcoming challenges to cultivate a more learned, cohesive Hawai‘i.

A future you can bank on

As for plans for the future of HNB, Bryan and Warren outline some things that have changed and will change, but also things that will remain the same. “At the heart of the whole thing is that we are a community bank, and we intend to remain a community bank.”

Bryan feels that it is their duty to be a part of this community in Hawai‘i and remaining so. “It’s not just about growth, it’s about helping build the local community.”

As a person in a unique position — learning from his father and now teaching his son, Warren has seen both sides as the bank has grown. “I just think that for Hawai‘i, locally owned businesses and family businesses are instrumental in helping the development of the economy and making sure the local people get taken care of.”

While times change, HNB’s integrity, philanthropy, responsibility and advocacy for Hawai‘i’s people and businesses won’t. Warren and Bryan Luke continue working to fulfill their mission of helping their customers achieve their goals.

Figuring out what is best for the people of Hawai‘i remains their priority — the “numbers” are just one side of that. For almost 65 years, Hawaii National Bank has been whole-heartedly here for the people — and so will it be for generations to come. You can bank on it.

Leave a Reply