Is estate planning really all about “who gets my stuff”? Your assets may be important, but when you sift through the reasons for doing estate planning, you may find that identifying who gets your stuff takes a distant back seat to far more important considerations.

For one thing, no matter how important your stuff is to you, your health and well-being are far more important. There could come a time when you cannot make or communicate decisions about your person and your care. Having your hand-picked decision-maker designated in your advance health care directive could make all the difference between family harmony and a peaceful exit, on the one hand, or a complete nightmare at the end of your days.

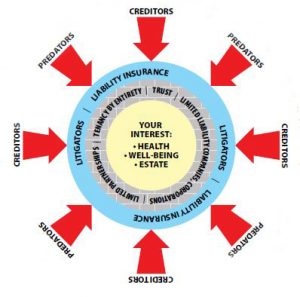

When it comes to your stuff, part of staying in control involves protecting it from creditors, predators, and plain old bad luck. Think of your estate plan as a castle. Imagine a large stone enclosure surrounded by a moat. In the old days, the moat would be stocked with alligators to discourage anyone from approaching the walls. With your present-day estate plan, you can stock the moat with a different kind of gators: litigators — attorneys paid for with insurance — to protect you from people who would like your stuff to be their stuff. Having adequate liability insurance is a critical element of your estate plan.

The walls of your castle represent various legal structures you can put in place to protect you, your home, your business, your rental properties, and your other assets. The legal structures for protecting your stuff might include trusts, limited liability companies, corporations, limited partnerships, or a combination of entities. You can also consider using a special kind of ownership with your spouse called tenancy by the entirety to protect your stuff from claims against one spouse, and to make it so that both spouses must agree to any mortgage, sale, or other transfer of the tenancy by the entirety property.

Ultimately, you will want your estate plan to assure that your stuff goes to whom you want, when you want, the way you want, with the lowest overall cost, delay, and loss of privacy. You may want to put special restrictions on a gift to one beneficiary without imposing the same restrictions on your other beneficiaries. You might have special assets or special situations (including a special needs loved one) that require careful planning. The only way to navigate the alternatives is with the help of experienced counsel who can educate you as to the available options and help you pick the ones that are right for you and your loved ones. Good counsel can help you build the castle that is just right for your situation.

Thinking of your estate plan as your castle helps you to zero in on your true values and objectives when it comes to making arrangements with your assets that will put you and your loved ones in the best possible position when something bad happens in the future.

SCOTT MAKUAKANE, Counselor at Law

Focusing exclusively on estate planning and trust law.

Leave a Reply