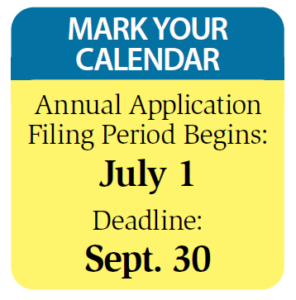

The City and County of Honolulu announces its 2025–26 Real Property Tax Credit program will open for applications starting July 1.

From July 1 until Sept. 30, 2024, eligible homeowners can apply for a tax credit to help alleviate their real property tax. To qualify for this tax credit for the 2025–26 tax year, applicants must:

Have a home exemption on their property.

Ensure that none of the titleholders own other property anywhere.

Confirm that the combined gross income of all titleholders does not exceed $80,000.

The amount of credit homeowners will receive, if qualified, is based on their income and current property tax amount. The program intends to provide relief to homeowners affected by rising property taxes or on a fixed income.

Qualified 2024–25 tax credit

Homeowners who qualified for this credit during the 2024–25 tax year may receive an application in the mail in early July.

Contact the Tax Relief Office for an application or download one at honolulu.gov/treasury starting July 1.

TAX RELIEF OFFICE

For more information, call 808-768-3205

or visit honolulu.gov/treasury

(Information furnished is subject to change without notice.)

Leave a Reply